Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

Lost w2 tax form

14 Mar 15 - 04:24

Download Lost w2 tax form

Information:

Date added: 14.03.2015

Downloads: 438

Rating: 421 out of 1193

Download speed: 26 Mbit/s

Files in category: 176

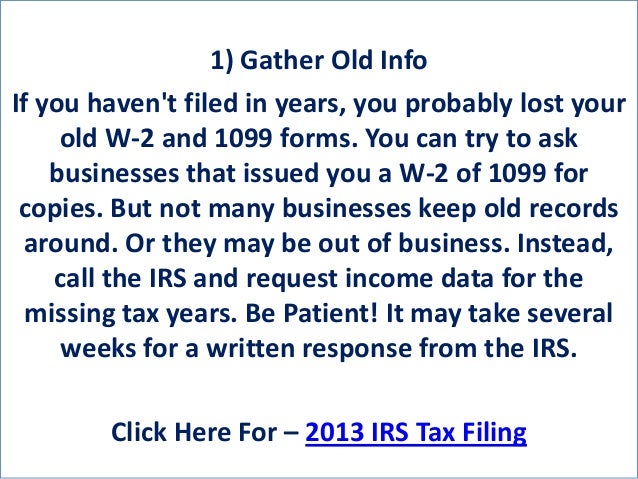

If you don't get your W-2 in time to file, use Form 4852, Substitute for Form You may need to correct your tax return if you get your missing W-2 after you file.

Tags: lost tax w2 form

Latest Search Queries:

document free living will

voluntary acknowledgement of paternity form oregon

document saveas

Feb 7, 2014 - Ready to work on your tax returns but can't find your forms W-2, Or maybe the address is correct but your form got lost in the mail (it happens).Mar 26, 2008 - Best Answer: Danger to your security ? You mean you are in mortal danger because you did not receive your W2 just kidding :)If i lost my W-2 form can i still file tax for 2011?27 Aug 2012What if I lost my W-2 tax form?26 Jun 2012how do i replace lost w-2 forms so i can file my taxes?10 Mar 2007How can a lost W-2 be replaced?26 Oct 2006More results from answers.yahoo.comWhat Do I Do If I Lost My W2 & Records to File Income Taxes?classroom.synonym.com › Campus CultureCachedSimilarThe Internal Revenue Service expects you to file a tax return if you earned income in the previous year and meet the tax filing earnings threshold. If you lose your Apr 2, 2013 - Form W-2 is one of the most essential pieces of paper when filing your taxes. If you've lost a W-2 -- or if you never got one in the first place Jan 26, 2015 - For a lost 2013 Form W-2, ask your employer or payroll department for a from the IRS, if your request is for a year you filed a tax return.

Jan 27, 2015 - Wondering when you should expect your form W-2 or 1099? If you do not receive your missing forms by Tax Day, April 15, file the form 4852. Either way, you need your W-2 to show your income and withholding amounts. If you've lost your W-2, you still need to file your tax return by the due date to Employees are then responsible for filing their W2s with the appropriate state and federal tax forms. Sometimes, W2 forms are lost, misplaced, or never received. File your return You still must file your tax return or request an extension to file File a Form 1040X On occasion, you may receive your missing W-2 after you

document management controls, the game document

Alternative called form gene, Pennsylvania i 9 form, Horizontal analysis of income statement, Oracle administrators guide, Empire records report.

735774

Add a comment